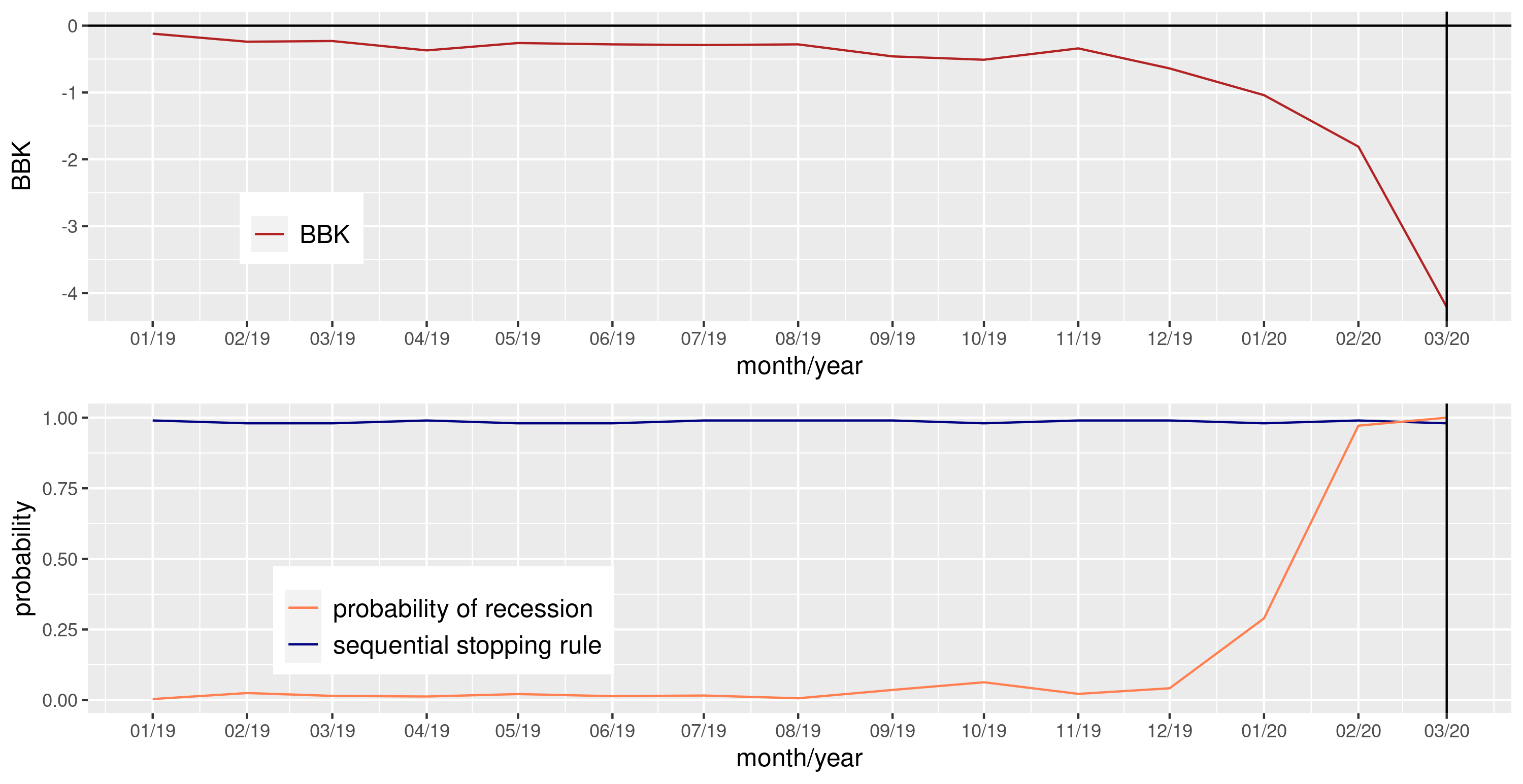

Monitoring recessions is inherently a problem of sequential statistical decision making: upon each arrival of data, a decision is made to either announce the onset of a recession or recovery or no sufficient evidence to suggest so. Such decisions will incur two risks: false alarm and delayed detection. Furthermore, to reduce one risk, one needs to accept more of the other risk. To achieve optimality, the decision-maker will need to strike a balance between these two risks. Li et al. (2020) developed a monitoring schema that consists of the probability of recession or recovery and a sequential decision rule that minimizes the decision-maker's Bayes risk function.

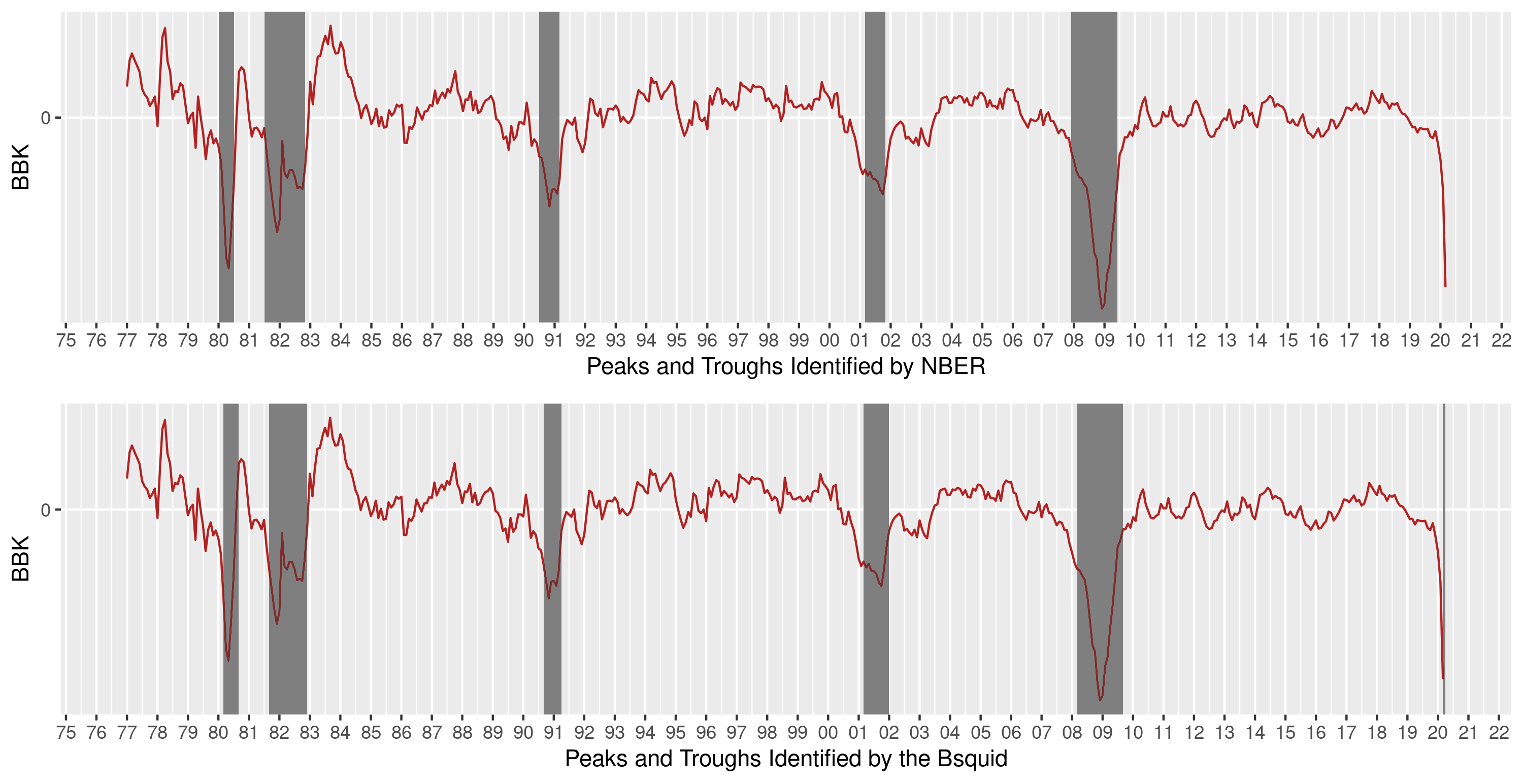

We monitored the COVID-19 induced recession and reported the onsite of the recession on March 2020. When the probability of recession crosses the sequential stopping rules from below, it is the time to announce the onset of the recession.

References

Li H., Sheng S., Yang J., 2020. Monitoring Recessions: A Bayesian Sequential Quickest Detection Method, International Journal of Froecasting